Bad Debts Income Statement Definition

Company xyz records 1 000 000 in revenue on its income statement and 1 000 000 in accounts receivable on the balance sheet we are assuming the customers have 60 days to pay.

Bad debts income statement definition. Its second entry would be its deduction from the debtors in the balance sheet since they are now not recoverable. Company xyz discovers that one of its customers big store is not doing very well. Bad debts being an expense are recorded under operating expenses in the income statement or on the debit side in the profit loss a c. These write offs must appear in your financial records so it s important to know how to list bad debt on an income statement.

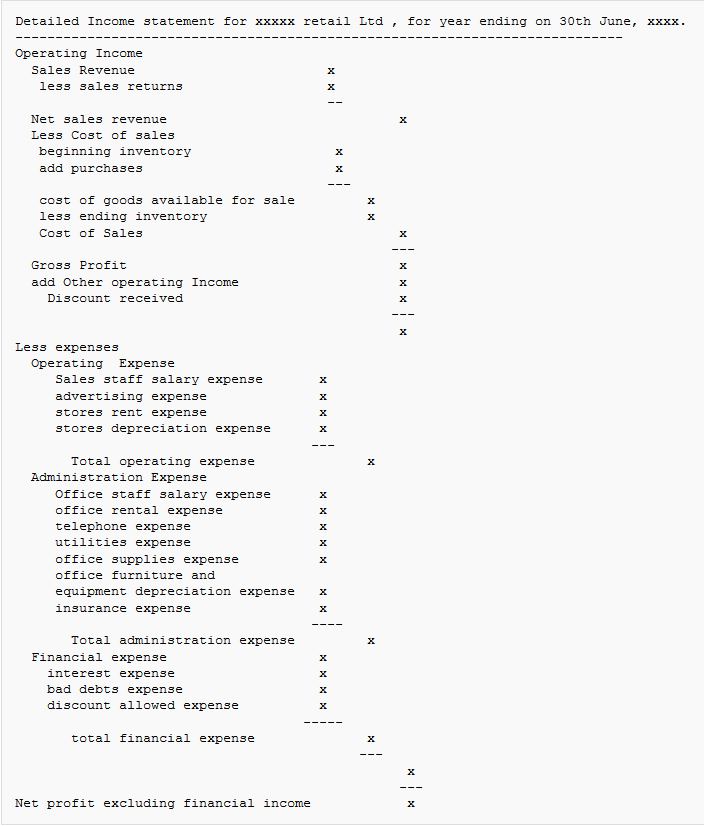

The direct write off method under the direct write off method you charge an unpaid invoice directly to the bad debt expense account on the profit and loss statement when it becomes obvious that a specific customer will not pay. Provision for bad debts can have a major impact on the financial statement of the company because it directly affects the profit and loss statement of the company which is always required to give a true and fair view of the financial statements. The income statement shows the aggregate financial position of a business during a specified period by displaying the amount of revenue generated and expenses incurred by a business. Definition of bad debts.

Recognizing bad debts leads to an offsetting reduction to accounts. The bad debts associated with accounts receivable is reported on the income statement as bad debts expense or uncollectible accounts expense. This information is also important to know when it comes time to file your taxes. Bad debts form a part on the debit side in the income statement as an expense.

Bad debts is also used for notes receivable that will not be collected. Bad debt expense is a receivable that is no longer collectable also called an uncollectable account this can happen when a company allows a customer to put a purchase on credit. Let s assume that company xyz sells 1 000 000 worth of goods to 10 different customers. Example of bad debt expense.

The term bad debts usually refers to accounts receivable or trade accounts receivable that will not be collected. Listing bad debt on an income statement in order to comply with iras tax laws you have to write off bad debts in your accounts. Bad debt expenses are generally classified as a sales and general administrative expense and are found on the income statement. Just about every department stock and home improvement stock offers their own credit cards.

Therefore the estimation of the same should be made based on the past performance of the company.