Depreciation Of Income Producing Assets

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

To deduct the depreciation expense of an asset it must meet the following criteria.

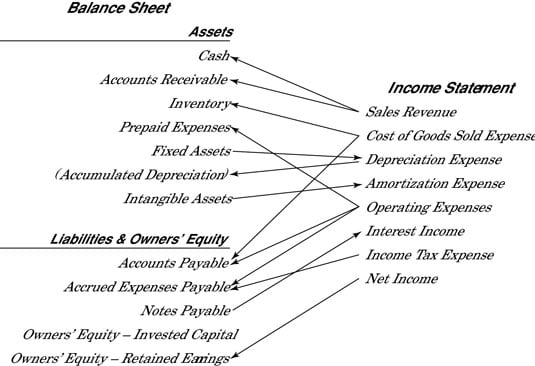

Depreciation of income producing assets. Any business or income producing activity using tangible assets may incur costs related to. Depreciation is calculated for general tax and ledger purposes using one or several methods but the most common and easiest depreciation method to learn is the straight line method. Depreciation is essentially an accounting transaction that spreads out the tax benefits of a business expense over the lifetime of the asset purchased. You must own the property.

Property depreciation refers to the natural wear and tear that occurs to a building and the assets within it over time. You must use the property in business or in an income producing activity. Business assets that deteriorate over time but last at least one year usually qualify for depreciation. Depreciation is technically a method of allocation not valuation even though it determines the value placed on the asset in the balance sheet.

Depreciation expense allows companies to recover the value of their income producing property or assets that typically expires through use and over time. The asset must have a determinable useful life of more than one year.

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Difference_between_Revenue_and_Sales_Oct_2020-012-e50d6c289ebf4d00987fbae938815fd4.jpg)

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)