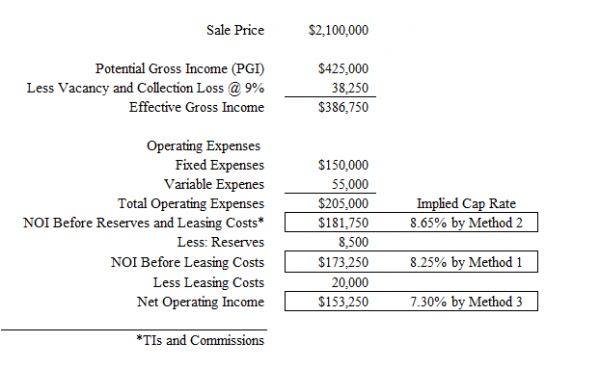

Effective Gross Income Minus Operating Expenses

Property management fees are the expense paid when you hire a property pro real estate management company to enroll tenants collect rent resolve tenant problems and oversee property maintenance and repairs.

Effective gross income minus operating expenses. Take that gross income of 155 000. If your monthly maintenance and other costs are 2 500 you have 30 000 a. This is an important figure when considering the. Also known as gross profit gross income doesn t include expenses such as salaries income taxes and office supplies gross profit is used to figure out a company s gross margin which measures how efficiently your company is producing and distributing its products it s a good way to get a big picture account of how well your company is using its resources and how it measures up to other.

Effective gross income is 285 000 300 000 minus a vacancy factor of 15 000. Operating expense formula example 3. To illustrate the computation of operating expenses using both. Calculate the percentage to calculate the operating expense percentage divide operating expenses by effective gross income.

Assuming a vacancy rate of 5 and annual operating expenses. An apartment complex contains 30 units that each rent for 400 per month. Therefore the operating expense of the company during the given period was 13 25 million. Operating income is a company s profit after subtracting operating expenses or the costs of running the daily business.

You answered incorrectly this income or math formula is equal to the net operating income noi. Operating expense 40 00 million 10 50 million 16 25 million. The effective gross income egi is the combination of your annual potential gross income and other property revenue minus your vacancy allowance. Positive cash flow to cover monthly operating expenses.

Operating expense 13 25 million. Vacancy and collection losses c. Noi equals your gross income minus your operating expenses advises propertyclub. Fixed and operating expenses d.

Effective gross income equals potential gross income minus. 10 of 11 effective gross income minus total operating expenses equals net gross income. Fixed operating expenses and vacancy and collection losses. Effective gross income is the potential gross rental income plus other income minus vacancy and credit costs of an investment property.

Effective gross income base rental income add other income minus tenant vacancy turnover.