Income Limit For Roth Ira Contribution

Traditional iras retirement plan at work.

Income limit for roth ira contribution. Start with your modified agi. 2020 roth ira income limits filing status modified agi contribution limit married filing jointly or qualifying widow er less than 196 000 6 000 7 000 if you re age 50 or older 196 000 to. Your roth ira contribution limit depends on your tax filing status and your modified adjusted gross income magi. Eligibility to make a roth contribution if you are married and filing separately single or filing as a head of household you can contribute to a roth ira in tax year 2021 up to the limit for your age if your modified adjusted gross income magi is less than 125 000.

196 000 if filing a joint return or qualifying widow er. You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira. Magi is less than 125 000. Subtract from the amount in 1.

For 2020 the roth ira contribution limit is phased out based on the following income levels. If you don t know your magi see below for information on how to calculate it. Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income exceeds. For single or head of household filers the phase out range is 124 000 to 139 000.

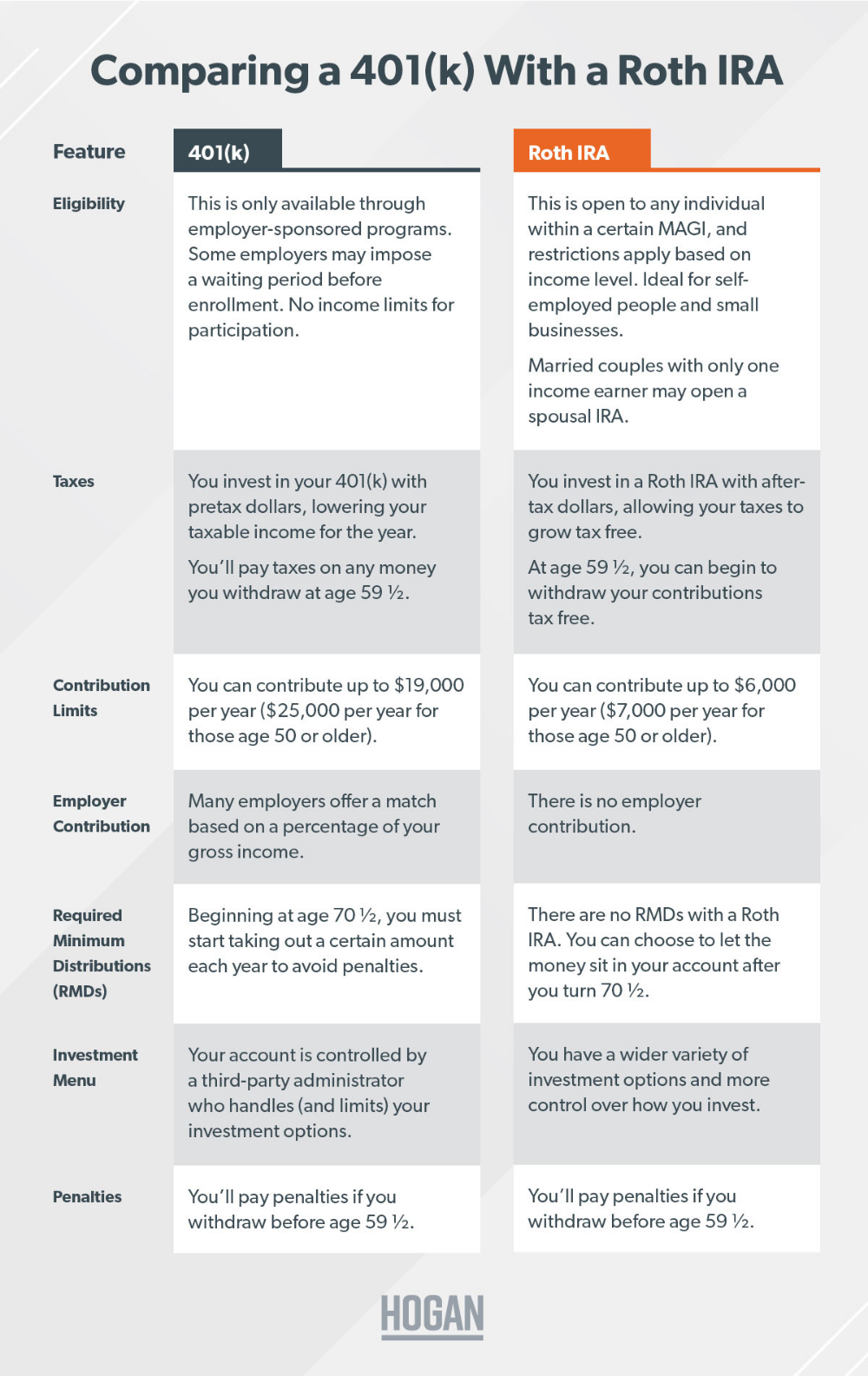

Amount of your reduced roth ira contribution if the amount you can contribute must be reduced figure your reduced contribution limit as follows. 2021 roth ira income limits filing status modified agi contribution limit married filing jointly or qualifying widow er less than 198 000 6 000 7 000 if you re age 50 or older 198 000 to. The ira catch up contribution limit will remain 1 000 for those age 50 and older 401 k participants with incomes below 76 000 125 000 for couples are additionally eligible to make traditional ira contributions the roth ira income limit is 140 000 for. But there are other factors that could place further limits on how much you can.

The ira contribution limit is 6 000. See ira contribution limits. The ira catch up contribution limit will remain 1 000 for those age 50 and older.