Income Summary Closing Entries T Accounts

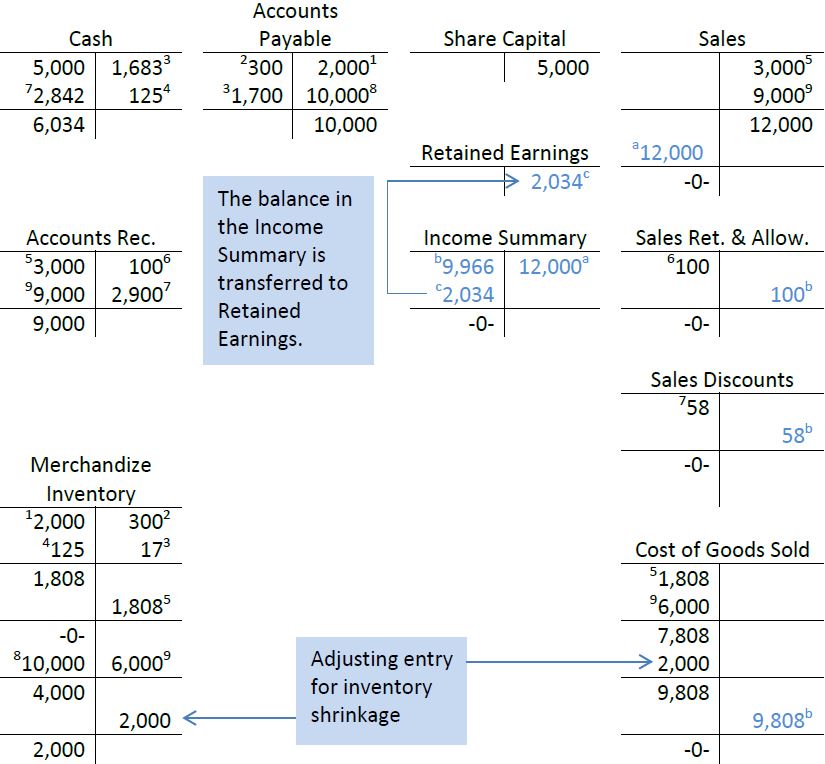

In other words the income summary account is simply a placeholder for account balances at the end of the accounting period while closing entries are being made.

Income summary closing entries t accounts. All of paul s revenue or income accounts are debited and credited to the income summary account. The income summary account is a temporary account used to store income statement account balances revenue and expense accounts during the closing entry step of the accounting cycle. The income summary account is an account that receives all the temporary accounts of a business upon closing them at the end of every accounting period fiscal year fy a fiscal year fy is a 12 month or 52 week period of time used by governments and businesses for accounting purposes to formulate annual financial reports. Insert closing entries to all revenue t accounts.

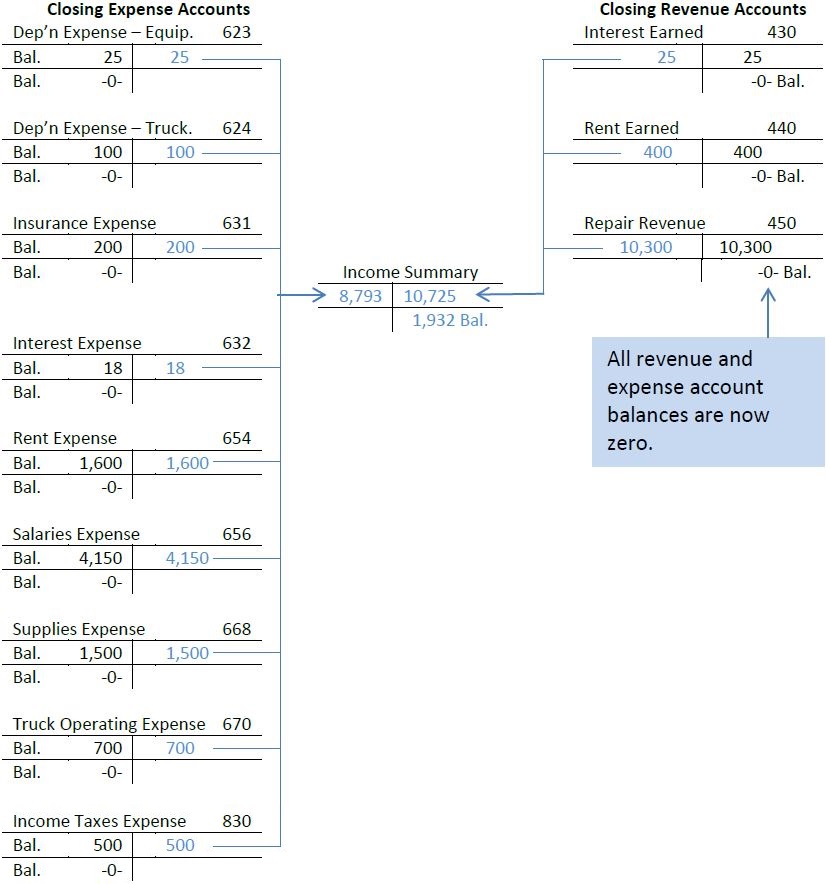

There are three general closing entries that must be made. Close income summary account. It s a visual representation of individual accounts that looks like a t making it so that all additions and subtractions debits and credits to the account can be easily tracked and represented visually. Review the income statement columns of the worksheet completed in requirement 4.

Income summary is a temporary account in which all the closing entries of revenue and expenses accounts are netted at the end of the accounting period and the resulting balance is considered as profit or loss. Close all revenue and gain accounts. It should income summary should match net income from the income statement. What is income summary.

Record debits first then credits. Date accounts debit dec. The debit to income summary should agree to total expenses on the income statement. 31 service revenue 19 250 clos.

Let s look at the t account for income summary. Notice the balance in income summary matches the net income calculated on the. A fiscal year fy does not necessarily follow. At this point you have closed the revenue and expense accounts into income summary.

This resets the income accounts to zero and prepares them for the next year. Closing for expense accounts. Here is the journal entry to close the expense accounts. Expense accounts have debit balances.

Closing an expense account means transferring its debit balance to the income summary account the journal entry to close an expense account therefore consists of a credit to the expense account in an amount equal to its debit balance with an offsetting debit to the income summary. This guide to t accounts will give you examples of how they work and how to use them. The balance in income summary now represents 37 100 credit 28 010 debit or 9 090 credit balance does that number seem familiar. Do this by entering the date and the opposite of the current balance.

1 income summary credit 19 250 close expenses for the period. After these two entries the revenue and expense accounts have zero balances.