Income Summary Credit Or Debit

Close the income summary account.

Income summary credit or debit. The debit to income summary should agree to total expenses on the income statement. This is the first step to take in using the income summary account. When you make out april s financial. We will also close these accounts to income summary.

Here is the journal entry to close the expense accounts. Debit and credit when the accounts in the income statement are transferred the values are debited from the accounts and then credited to the income summary account. First the revenue account s are closed by debiting them and crediting the income summ. The following is an example of an income summary.

This is the only time that the income summary account is used. The income statement is used for recording expenses and revenues in one sheet. This leaves you with 75 000 net profits in the income summary account. After these two entries the revenue and expense accounts have zero balances.

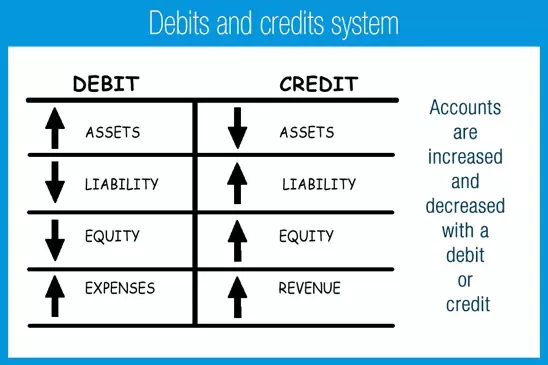

The income summary account is used when closing the books at the end of each accounting period e g each month in a manual accounting system. This amount is considered a credit on an income statement which calculates money that comes into a business and then calculates money that goes out in a separate portion of the document. If the income summary has a debit balance the amount is the company s net loss. As you can see the income and expense accounts are transferred to the.

Debit the income summary for that amount and credit the retained earnings account on the balance sheet. Example of income summary. The exceptions to this rule are the accounts sales returns sales allowances and sales discounts these accounts have debit balances because they are reductions to sales. In the last credit balance or debit balance whatever may become it will transfer into retained earnings or capital account in the balance sheet and the income summary will be closed.

For the rest of the year the income summary account maintains a zero balance. You credit expenses for 225 000 and debit the income summary account for an equal quantity. These accounts normally have credit balances that are increased with a credit entry. The gross income for a business is the total amount it collects in exchange for products and services.

Let s look at the t account for income summary. If the resulting balance in the income summary account is a profit which is a credit balance then debit the income summary account for the amount of the profit and credit the retained earnings account to shift the profit into retained earnings which is a balance sheet. This transfers the income or loss from an income statement account to a balance sheet account.