Income Summary In General Ledger

A debit amount for the total amount of the general ledger income statement accounts that had debit balances next if the income summary has a credit balance the amount is the company s net income.

Income summary in general ledger. When entries 1 and 2 are posted to the general ledger the balances in all revenue and expense accounts are transferred to the income summary account. Sardar hammad is sole owner of business. The net balance of the income summary account is closed to the retained earnings account. The abbreviation adj and clos have been entered in the explanation columns of the ledger the dividends account will have a 0 balance after closing the income summary account will show three closing entries.

Then you throw in expenses. The debit to income summary should agree to total expenses on the income statement. The income summary account is a temporary account used to store income statement account balances revenue and expense accounts during the closing entry step of the accounting cycle. A fiscal year fy does not necessarily follow.

What is income summary. The net result of income less expenses becomes retained earnings. In the closing stage balances in all income accounts are transferred to the income summary account by debiting. You take your net income from various sources and transfer them to the income summary account.

Reinvestment in the shape of cash 80 000 and furniture 20 000. Following are transaction for the month of august 2016 prepare journal entry general ledgers and trial balance. The income summary account is an account that receives all the temporary accounts of a business upon closing them at the end of every accounting period fiscal year fy a fiscal year fy is a 12 month or 52 week period of time used by governments and businesses for accounting purposes to formulate annual financial reports. The income summary will be closed with a debit for that amount and a credit to retained earnings or the owner s capital account.

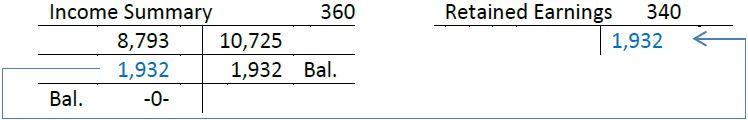

Notice the balance in income summary matches the net income calculated on the. He has been started business since 1990. In other words the income summary account is simply a placeholder for account balances at the end of the accounting period while closing entries are being made. Notice that a zero balance results for each revenue and expense account after the closing entries are posted and there is a 1 932 credit.

After the expense and revenue accounts are closed the company must make an entry in the general journal to close the income summary account. Income summary account is a temporary account used in the closing stage of the accounting cycle to compile all income and expense balances and determine net income or net loss for the period. The transfer of these balances is shown in figure 3 7. The balance in a company s income summary account must be transferred to retained earnings to take the amount off the company s books.

Here is the journal entry to close the expense accounts.