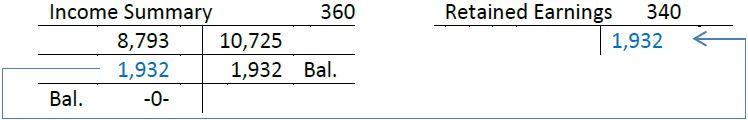

Income Summary Retained Earnings

Only then is the account closed.

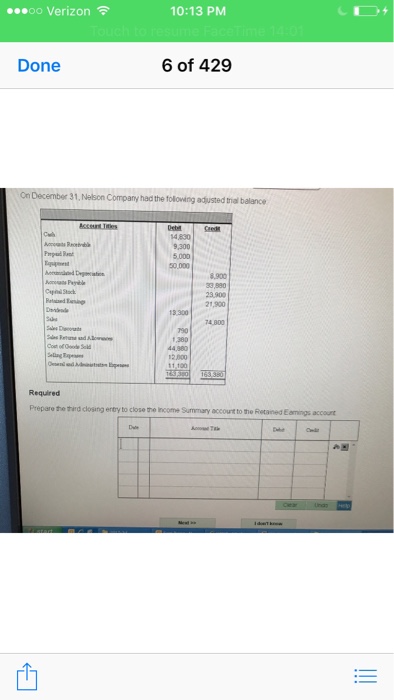

Income summary retained earnings. This leaves you with 75 000 net profits in the income summary account. You credit expenses for 225 000 and debit the income summary account for an equal quantity. A summary report called a statement of retained earnings is also maintained outlining the changes in re for a specific period. Close the income summary account.

Income summary allows us to ensure that all revenue and expense accounts have been closed. The income summary will be closed with a debit for that amount and a credit to retained earnings or the owner s capital account. Then the income summary account is zeroed out and transfers its balance to the retained earnings for corporations or capital accounts for partnerships. Credit to the retained earnings account.

If the income summary has a debit balance the amount is the company s net loss. Example of an income summary account. Rather than closing the revenue and expense accounts directly to retained earnings and possibly missing something by accident we use an account called income summary to close these accounts. Retained earnings as at 1 january 2014 were 20 million.

Dividing this price rise per share by net earnings retained per share gives a factor of 58 82 28 87 2 037 which indicates that for each dollar of retained earnings the company managed to. The purpose of retained earnings retained earnings represent a useful link between the income statement and the balance sheet balance sheet the balance sheet is one of the three fundamental financial statements. This transfers the income or loss from an income statement account to a balance sheet account. Using income summary in closing entries.

The income summary account holds these balances until final closing entries are made. Income summary account is a temporary account used in the closing process to close revenues and expenses for the period. Debit the income summary for that amount and credit the retained earnings account on the balance sheet.