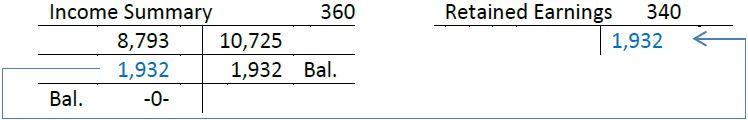

Income Summary To Retained Earnings

You can either close these accounts directly to the retained earnings account or close them to the income summary account.

Income summary to retained earnings. This leaves you with 75 000 net profits in the income summary account. The following is an example of an income summary. Closing temporary accounts to the income summary account does take an extra step but it also provides and an audit trail showing the revenues expenses and net income for the year. Credit to the retained earnings account.

Example of income summary. In the last credit balance or debit balance whatever may become it will transfer into retained earnings or capital account in the balance sheet and the income summary will be closed. Income summary account is a temporary account used in the closing process to close revenues and expenses for the period. Income summary allows us to ensure that all revenue and expense accounts have been closed.

The income summary will be closed with a debit for that amount and a credit to retained earnings or the owner s capital account. Afterward the balance in the income summary account is transferred to the retained earnings account if the business is a corporation or to the capital account of the owner for a sole proprietorship. If the income summary has a debit balance the amount is the company s net loss. Using income summary in closing entries.

Rather than closing the revenue and expense accounts directly to retained earnings and possibly missing something by accident we use an account called income summary to close these accounts. Debit the income summary for that amount and credit the retained earnings account on the balance sheet. You credit expenses for 225 000 and debit the income summary account for an equal quantity.