Income Tax Return Japan

A resident taxpayer is required to file a final return for each calendar year by 15 march of the following year and pay income tax.

Income tax return japan. 1 what is filing return for refund. National tax agency japan new topics information for taxpayers publication press release about us contact us announcement of the event enjoying the sake of western honshu on 21 november 2020 pdf 420kb. A resident taxpayer who receives employment income from outside of japan is required to file a tax return. Income tax is imposed on the variation of person s residency condition such as whether they are resident or non resident in japan.

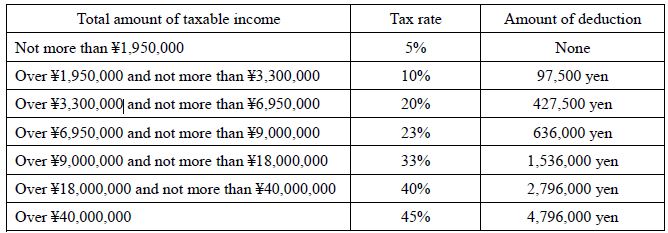

In case a person has employment income the person needs to submit individual income tax return in any following case. Japanese local governments prefectural and municipal governments levy local inhabitant s tax on a taxpayer s prior year income. Generally in japan the local inhabitant s tax is imposed at a flat rate of 10. The rates you pay for both kinds of tax are calculated according to your earnings.

A company worker in japan usually does not have to file income tax returns because its employer withholds income tax from monthly salary and bonus. The employer will make adjustments for the withholding tax on december or next january payroll so that the aggregated amount of the withholding tax becomes the same to the annual tax due amount for each employee. If total amount of annual employment income is exceeding 20m jpy. Even when you are not legally required to file the final tax return forms if the amount of taxes withheld from salaries and wages or the amount of estimated tax prepayment exceeds the income tax calculated based on your annual income for the year you can claim a refund for income tax by filing the final tax return.

Even if there is no payment due final tax return has to be submitted to tax office within 2 months after the end of corporation s. February and march in japan is tax season when all residents receive a kakutei shinkoku 確定申告 tax return form from their local tax office. Important thing is that in japan local taxes inhabitant tax. An individual tax return must be filed if income exceeds a specified amount.

This applies where the taxpayer is a resident of japan as of january 1 of the current year. Corporation income taxes in japan are comprised of the following taxes. Income tax in japan is based on a self assessment system a person determines the tax amount himself or herself by filing a tax return in combination with a withholding tax system taxes are subtracted from salaries and wages and submitted by the employer.