Japan Income Tax Law

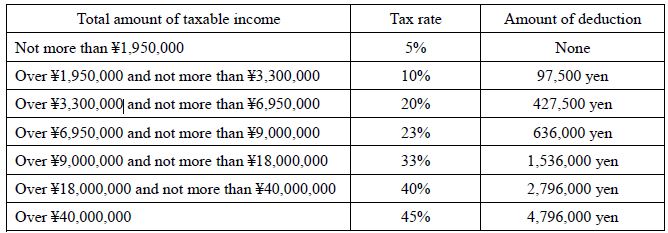

At present the following tax brackets apply.

Japan income tax law. This applies where the taxpayer is a resident of japan as of january 1 of the current year. 3 a domestic corporation shall be liable to pay income tax pursuant to this act when it receives in japan payment of taxable income of a domestic corporation or receives payment of taxable income of a foreign corporation attributed to the trust property under a trust subject to corporation taxation for which it accepts the position of trustee. In other words the higher the income the higher the rate of tax payable. Japan s tax credit is a basic fixed allowance available to all single taxpayers without dependents.

Generally in japan the local inhabitant s tax is imposed at a flat rate of 10. Taxation in japan is based primarily upon a national income tax 所得税 and a residential tax 住民税 based upon one s area of residence. The tax rate for an individual in 2020 is between 5 45 there are reduced rates of tax for certain income earners. Taxation of an individual s income in japan is progressive.

A tax credit is a fixed amount of money that may be kept by taxpayers without paying any income taxes. Japan corporate tax in 2020 is 23 2 for companies with share capital above 100 million yen. Japan provides most taxpayers with an income tax allowance of 380 000 which can be kept as a tax free personal allowance. 8m x 23 1 84m 0 636m 1 204m.

Income from retirement benefits and salary is subject to progressive tax rates while a maximum tax rate of 20 is applied to the other types of income. Japanese local governments prefectural and municipal governments levy local inhabitant s tax on a taxpayer s prior year income. The constitution of japan declares the principle of taxation under the law in article 30 the people shall be liable to taxation as provided by the law and in article 84 no new taxes shall be imposed or existing ones modified except by law or under such conditions as the law may prescribe. So for example a single taxpayer with a taxable income of 8 million would fall in the 23 tax bracket and pay 1 204 million in taxes.

There are consumption taxes and excise taxes at the national level an enterprise tax and a vehicle tax at the prefectural level and a property tax at the municipal level. Income tax in japan is based on a self assessment system a person determines the tax amount himself or herself by filing a tax return in combination with a withholding tax system taxes are subtracted from salaries and wages and submitted by the employer.