Japan National Income Tax Rates

The standard tax rate is 3 2 as prefectural tax and 9 7 as municipal tax.

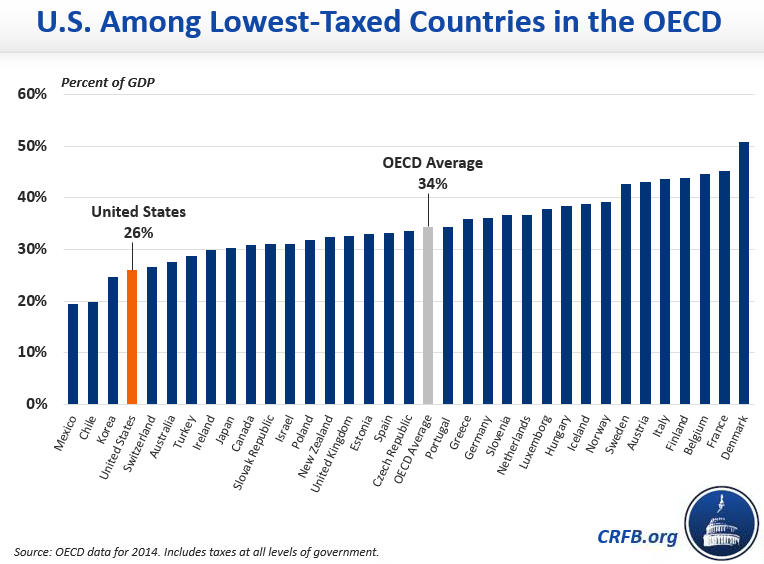

Japan national income tax rates. Inheritance and gift taxes will not apply to foreign properties if inheritance or gift is made after the foreign national leaves japan on april 1 2018 or later. The personal income tax rate in japan stands at 55 95 percent. Local income taxes generally in japan the local inhabitant s tax is imposed at a flat rate of 10. The tax rate for an individual in 2020 is between 5 45 there are reduced rates of tax for certain income earners.

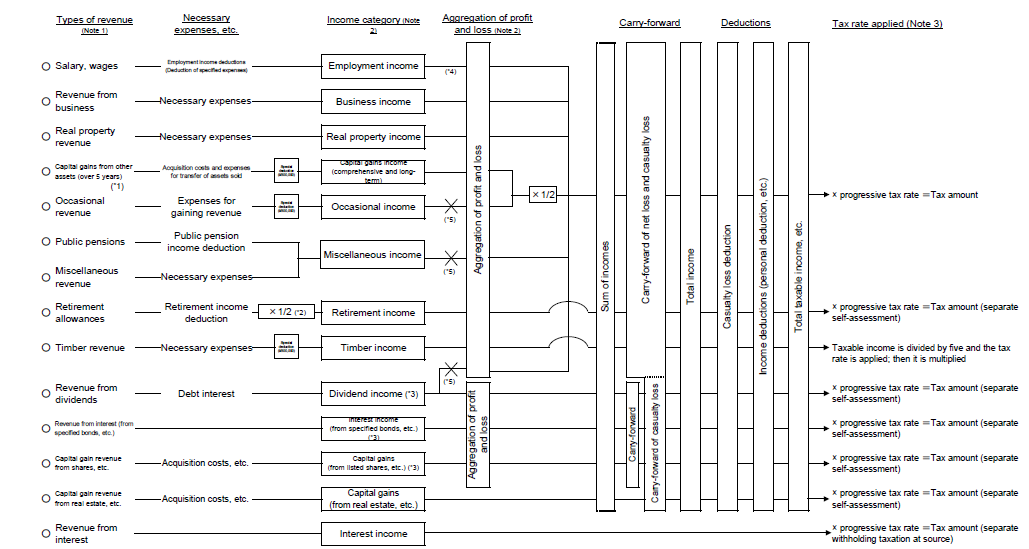

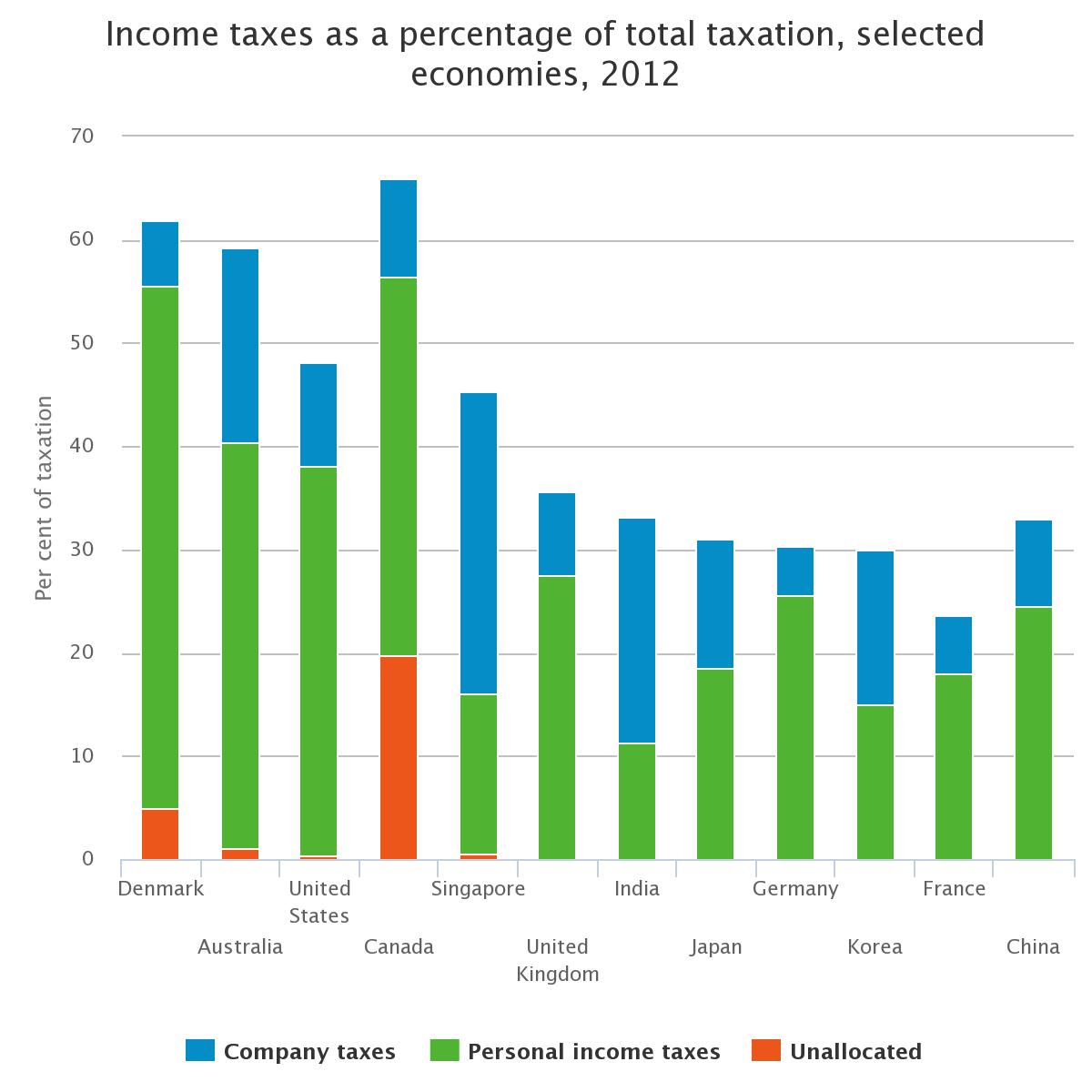

Long term gains are taxed at a flat rate of 15 315 percent including surtax of national income tax plus 5 percent of local inhabitant tax. How does the japan income tax compare to the rest of the world. Short term gains are taxed at a flat rate of 30 63 percent including surtax of national income tax plus 9 percent of local. Rates national income tax rate taxable income rate up to jpy 1 950 000 5 5 105 including surtax jpy 1 950 001 jpy 3 300 000 10 10 21 including surtax jpy 3 300 001 jpy 6 950 000 20 20 42 including surtax jpy 6 950 001 jpy.

National tax agency japan new topics information for taxpayers publication press release about us contact us announcement of the event enjoying the sake of western honshu on 21 november 2020 pdf 420kb. In other words the higher the income the higher the rate of tax payable. Personal income tax rate in japan averaged 51 65 percent from 2004 until 2019 reaching an all time high of 55 95 percent in 2016 and a record low of 50 percent in 2005. Japan has a bracketed income tax system with six income tax brackets ranging from a low of 5 00 for those earning under 1 950 000 to a high of 40 00 for those earning more then 18 000 000 a year.

Taxation of an individual s income in japan is progressive. National income tax rates taxable income tax rate less than 1 95 million yen 5 of taxable income 1 95 to 3 3 million yen 10 of taxable income minus 97 500 yen 3 3 to 6 95 million yen 20 of taxable income minus 427 500 yen 6 95 to 9 million yen 23 of. From tax years beginning on or after 1 october 2019 the rate is increased as follows.

:max_bytes(150000):strip_icc()/UAETaxBrackets2-0db7d9918b414b2e978772ebeeb0f101.jpg)