Paid Income Tax Journal Entry Class 11

Private limited companies.

Paid income tax journal entry class 11. Prepare a journal entry. 80 000 at 15 trade discount and 4 cash discount received 75 amount immediately through a cheque mar 10 purchased goods from richa for rs. In the above example the deferred tax will arise at 100. As per this concept we not only record the transactions that are in cash only but also those which relate to the accounting year whether in cash or not.

Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i e. 60 amount paid by cheque immediately. Subscribe subscribed unsubscribe 1. Sole proprietorship partnership and private limited company.

Prepare general journal entries for the following transactions of a business called pose for pics in 2016. Let s assume our company also has salaried employees who are paid. Paid rs 2 000 in cash as wages on installation of a machine. In order to determine the correct profit and loss and the true and fair financial position at the end of the year we need to account for all the expenses and incomes.

57 500 cash and rs. As we know that accounting is done on the basis of the accrual concept. Profit before tax is usually a gross profit less operating financial and other expenses plus other income. Journal entry for income tax income tax is a form of tax levied by the government on the income generated by a business or person.

32 500 of photography equipment in the business. 2016 mar 5 sold goods to shruti for rs. 60 000 at 10 trade discount and 5 cash discount. The journal entry to record provision is.

Hashim khan the owner invested rs. Provision of income tax provision of income tax recorded in books of account by debiting profit loss a c and it will show under liability in balance sheet. Provision amount is calculated by applying rate as per tax rules on profit before tax figure. Sold goods to manohar list price rs 4 000 trade discount 10 and cash discount 5 he paid the amount on the same day and availed the cash discount.

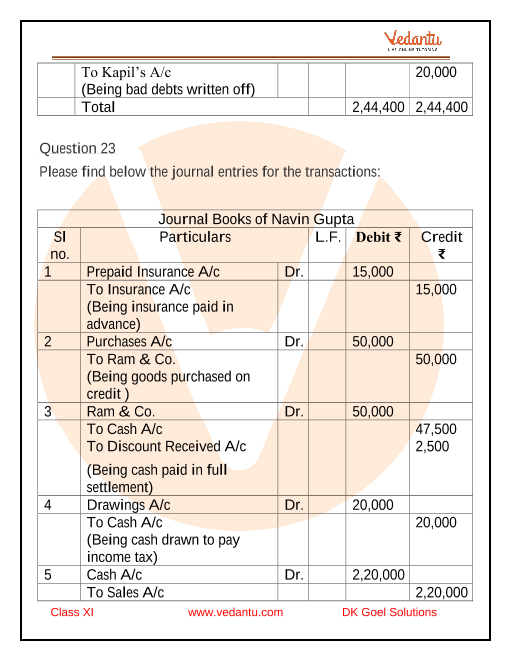

Journal entry of income tax accounting 1. Unsubscribe from my learnings. Examples of payroll journal entries for salaries note.