Rental Income Yield Meaning

Real estate brokers and sellers often calculate the yield before they put the property on sale in the market.

Rental income yield meaning. Understanding how property yield works gives you a better idea of the ongoing return you will earn on your investment. We have one property which we bought outright for 129000 and we rent this out for 600 pcm. Now if that does not make complete sense do not worry let me explain it to you. Working out your rental yield depends on the two main types of rental yield gross rental yield and net rental yield.

Gross rental yield what you are doing is you are looking at the value of a property or you are looking at the purchase price of the property. 22 518 divided by the property value of 300 000 equals a rental yield of 7 5 percent. Rental yield is the return a property investor is likely to achieve on a property through rent. We used part of this equity as a 35 deposit on a house we paid 140000 for and are renting out for 695 pcm and we are in the process of.

Now let s say that it cost you 300 000 to purchase the property. Why rental yield matters. Rental yield definition make text bigger. It can be better explained as the rate of returns from an investment.

It is a percentage figure calculated by taking the yearly rental income of a property and dividing it by the total amount that has been invested in that property. In other words if the estimated weekly rental on a flat is 200 the annual rental would be 52 times that or 10 400. I wonder if someone would be good enough to explain rental yield to me as i want to know i am on a sustainable track. In case you are wondering rental yield is defined as ratio of annual rent of the property to the total cost of the property.

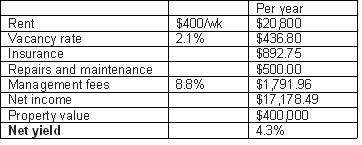

The yield of a property tells you how much of an annual return you are likely to get on your investment. Gross yield there s obviously a significant distinction between these two terms. An income of 27 360 minus the cost of 4 842 works out to 22 518 in rental income after expenses. Rental yield is essentially the amount of money you make on an investment property by measuring the gap between your overall costs and the income you receive from renting out your property.

Rental yield is the amount that you can expect a return on an investment roi before taxes maintenance fees and other costs. How rental yield is calculated. We then remortgaged another property we owned outright to raise the deposits for 2 more houses. Rental yield can be defined simply as the cash generated by your asset annually as a percentage of its value.