Unearned Interest Income Journal Entry

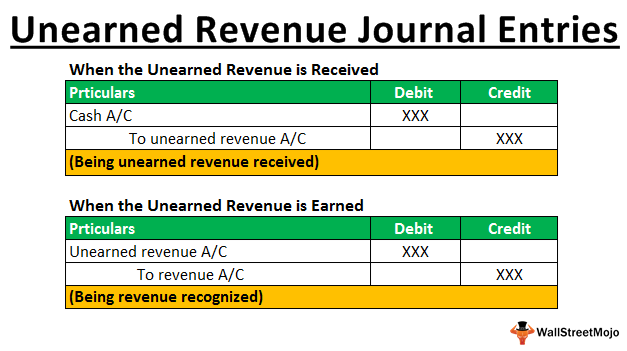

There are two ways of recording unearned revenue.

Unearned interest income journal entry. If a portion remains unearned at the end of the accounting period it is. 1 the liability method and 2 the income method. Journal entry for unearned interest income. The following unearned revenue journal entry example provides an understanding of the most common type of situations where such a journal entry account for and how one can record the same as there are many situations where the journal entry for unearned revenue pass it is not possible to provide all the types of examples.

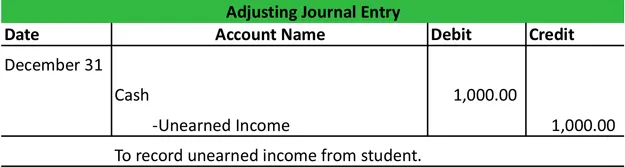

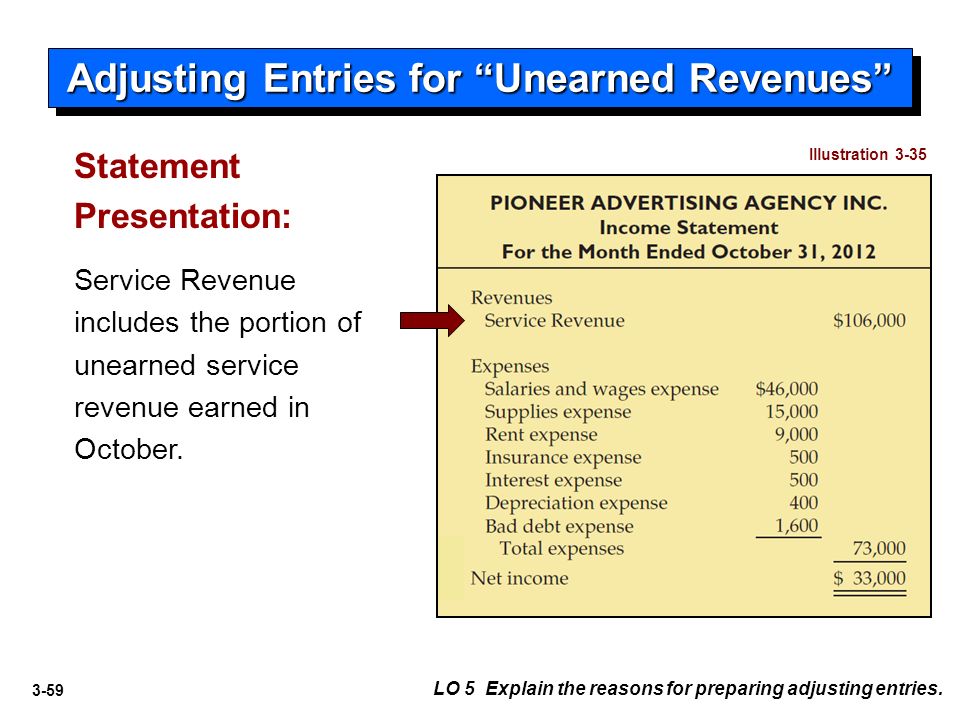

Journal entry for income received in advance. In other words the unearned income of 40000 should be taken out of the income account and transferred to another account which will be shown on the liabilities side of the balance sheet to indicate the companies obligation to render in the future service for which it has already been paid this is accomplished by the following journal entry. This is true at any time and applies to each transaction. At the end of the accounting period the following adjusting entry is made to convert a part of unearned revenue into earned revenue.

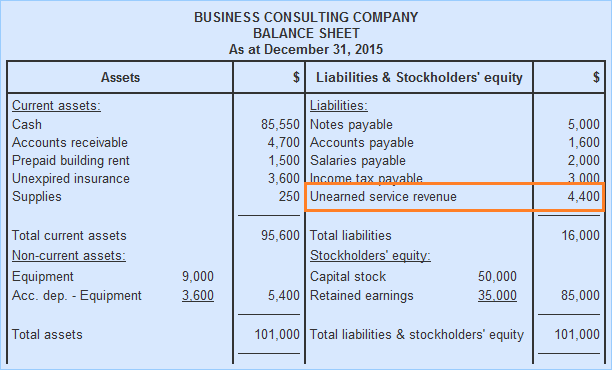

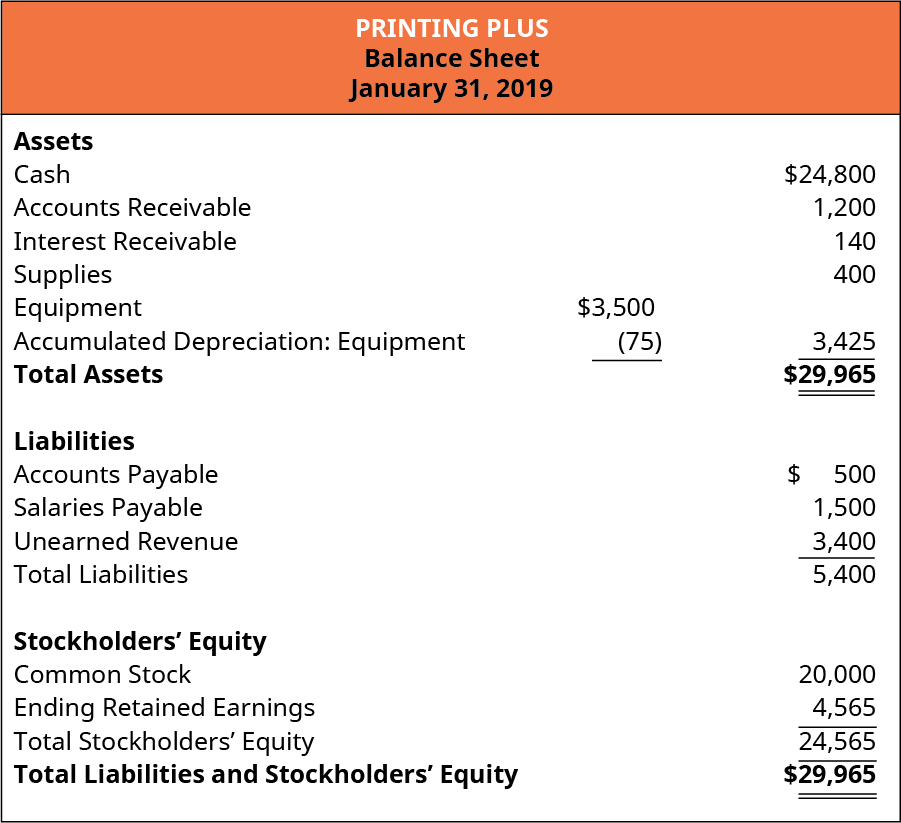

The adjusting entry for unearned revenue depends upon the journal entry made when it was initially recorded. Hence the company needs to account for interest income by properly making journal entry at the end of the period. The accounting equation assets liabilities owners equity means that the total assets of the business are always equal to the total liabilities plus the total equity of the business. Likewise this type of income is usually earned but not yet recorded during the accounting period.

Also known as unearned income it is income which is received in advance however the related benefits are yet to be provided it belongs to a future accounting period and is still to be earned. At the end of the period unearned revenues must be checked and adjusted if necessary. 2014 07 18 11 18 17 2014 07 18 11 18 17 debit cash bank credit unearned. Asked by wiki user.

Journal entry for income received in advance recognizes the accounting rule of credit the increase in liability. Under income method the entire amount received in advance is recorded as income by making the following journal entry. Journal entries of unearned revenue. Interest income is a type of income that is earned and accumulated with the passage of time.

Wiki user answered. Interest income journal entry overview.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)